Sydney house prices are expected to rise as much as 10 per cent this year, propelled by surging migration, a tight rental market and scant housing supply, according Westpac’s latest forecast.

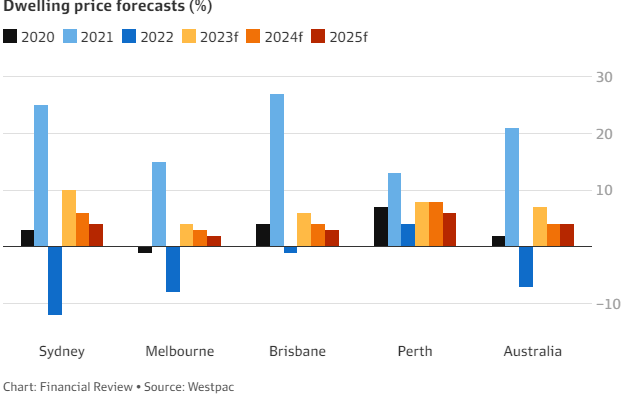

Westpac has significantly upgraded its expectations, tipping dwelling prices to rise 7 per cent nationally this year followed by a further 4 per cent next year. In April, Westpac had forecast prices to track flat overall nationally this year, followed by a 5 per cent lift next year. At that point, the bank’s economists expected Sydney prices to lift just 1 per cent this year.

After notching up 10 per cent this year, Sydney prices are anticipated to gain another 6 per cent in 2024, and 4 per cent in 2025 in Westpac’s revised view. Perth is expected to achieve the second strongest growth, with an 8 per cent gain this year, followed by Brisbane with 6 per cent and Melbourne prices at 4 per cent.

“Australia’s housing market has continued to outperform expectations, particularly with respect to prices,” senior economist Matthew Hassan wrote in his analysis on Monday.

“Across the five major capital city markets, dwelling prices have now risen 4 per cent over the year to date – a 5.2 per cent rebound from February’s low retracing just over half of the 9.7 per cent fall over the previous 10 months.”

Those gains were “well-sustained”, Mr Hassan wrote, despite four further rate hikes from the Reserve Bank of Australia between February and June. The progress of prices, turnover, auction activity, new finance approvals and sentiment all combined to paint a picture of a “broadening recovery, albeit one that is being led by prices with the volume of activity and demand still relatively subdued”.

“The impetus for gains looks to be mainly coming from a sharp acceleration in migration inflows and an associated tightening in rental markets, all against a backdrop of low levels of ‘on-market’ supply,” Mr Hassan wrote.

“The turnaround in price growth has been strongest for markets where population growth has seen the sharpest pick-up (Sydney and Melbourne) and much more muted in markets that have seen a less pronounced shift (Adelaide, Hobart and Darwin).”

Sydney’s house prices increased by 0.9 per cent in July, according to CoreLogic figures released at the start of this month. That represented the smallest gain since values started rising in February, prompting speculation that the rate of Sydney’s price growth may already have peaked.

Westpac’s Mr Hassan flagged a similar concern, noting there was “some fragility” in the rebound in prices, given that it has been underpinned by a relatively low amount of supply.

“If and when sellers come back, a shift in the supply-demand balance will test the ‘depth’ of demand, and price gains may prove harder to sustain. Indeed, some of these dynamics already look to be coming into play in the Sydney market.”

Westpac’s senior economist described the housing upturn as “abnormal”.

“Housing recoveries in the past have only tended to flow through to prices once the RBA is actively cutting rates or is very clearly poised to do so, and typically follow a sustained lift in turnover,” he wrote.

“Population drivers tend to act more slowly, and indirectly through tightening rental markets and firming yields attracting investor activity.”

Price growth is expected to slow as affordability constraints emerge, according to Westpac which has forecast prices to rise 4 per cent nationally in 2024 and 2025 despite interest rates easing.

Customer Service Manager:Michael Guo

Tel:0430680555

Email:office@ksiinvestments.com.au

Address:Suite 404, 53 Walker Street, North Sydney, NSW, 2060

General advice warning and Disclaimers