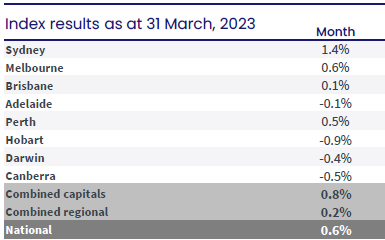

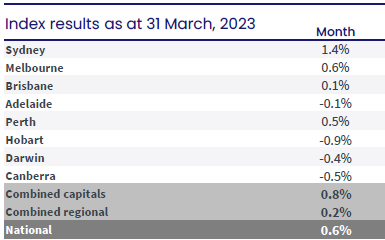

Sydney Property Market Surges by 1.4% in March

Australian house prices snapped 10 months of declines in March, led by a surge in the bellwether Sydney market in a positive sign for the economy after the central bank’s almost yearlong policy tightening cycle.

Low supply for at least the next 5 years

- Advertised supply has been below average since September last year while rental markets remain “extremely tight,” said Tim Lawless, research director at CoreLogic.

- A separate government report validated that view, showing net additions of apartments and dwellings such as town houses over the five years to 2026-27 are projected to be around 40% below levels seen in the late 2010s.

- While the supply shortfall is placing upward pressure on home prices, economists say a key factor that will weigh on the market in the longer term is expectations that borrowing costs will remain elevated until at least late 2024.

Returning immigrants boost demand

- The rebound “reflects buyers stepping back into the market given the fall in prices, low listings, some government support, the return of immigrants which is boosting underlying demand and ultra-tight rental markets.”